epf contribution 2018

KUALA LUMPUR Dec 21. Currently an employee contributes 12 of his or her basic salary as EPF contribution and a matching contribution is made by.

Epf New Basic Savings Changes 2019 Mypf My

Beginning January 2018 employees will no longer have the option of contributing 8 of their income to the Employees Provident Fund EPF.

. Beginning January 2018 employees will no longer have the option of contributing 8 of their income to the Employees Provident Fund EPF. Flexible Voluntary Contribution Effective 1 July 2018. It looks like the Employees Provident Fund EPF will be changing its employee statutory contributions rate back from 8 per cent to its original 11 per cent.

Besides EDLI Admin charges have already been waived wef. The new rate will be effective for salaries. Effective January 2018 wagesalary February 2018 EPF contribution the statutory contribution rate for employees share will revert to the original 11 per cent for members below age 60 and 55 per cent for those aged 60 and above.

The RM60000 contribution limit for all EPF voluntary contributions Self Contribution i-Saraan i-Suri Top-up Savings Contribution is based on a yearly basis from 1st January to 31st December. 75 in the case of functional non-functional organisations. 1 June 2018 subject to a minimum of Rs.

EPF announced that effective 1 July 2018 members who contribute voluntarily to their EPF accounts either through the 1Malaysia Retirement Scheme SP1M Self-Contribution or the Top-Up Savings Contribution can now do so in any amount as the requirement to contribute a minimum RM50 at any one. The Employees Provident Fund EPF reported an 8058 per cent increase in the number of usage of its flagship electronic service i-Akaun in its first quarter Q1 2018 Operations results to 1112 million from 616 million in the corresponding period last year. KUALA LUMPUR 12 June 2018.

This will be effective from the January 2018 salary for February 2018 contribution. Both the employer and the employee contribute towards the EPF for the employee. Effective for salaries from January 2018 February 2018 EPF contribution onwards this change will see a reversion to 11 per cent for employees aged below 60 and 55 per cent for employees aged 60 and above.

EPF contribution by women employees reduced to 8 from 12. Next year the Employees Provident Fund EPF contribution rate by employees will revert to the original 11 percent for members aged below 60 and 55 percent for those 60 and above. The new rate will be effective for salaries.

Instead the statutory contribution rate for employees share will revert to the original 11 for members below the age of 60 and 55 for those aged 60 and above. PF Admin charges have been further reduced from 065 to to 05 applicable wef. You may find more information on the EPF Self Contribution website.

Full pension is payable on completion of. Under Provident Fund become members of Pension Scheme. KUALA LUMPUR Dec 21.

The EPF receives and manages retirement savings for all its members encompassing mandatory contributions by employees of the private and non-pensionable public sectors as well as voluntary contributions by those in the informal sector. Instead the statutory contribution rate for employees share will revert to the original 11 for members below the age of 60 and 55 for those aged 60 and above. Th employees should work for a minimum of 10 years to avail themselves.

The rate of contribution is 12 if the salary of the employee above Rs. 833 of Basic Salary upto Rs15000- is contributed to Pension Scheme from employers share of contribution. It may be noted that Expenditure incurred by EPFO in administering the Provident Fund.

Employers are required to ensure the right amount of contributions are deducted from their employees salary and remitted to the EPF in accordance. Effective January 2018 cycle February 2018 EPF contribution the statutory contribution rate for employees share will revert to the original 11 for members below age 60 and 55 for those aged 60 and above. A minimum period of ten years of contributory service is required to be eligible to receive monthly Pension.

How Malaysias EPF schemes are being enhanced from 1 January 2018.

Epf Contribution Rate 2022 23 Employee Employer Epf Interest Rate

Budget 2018 Epf Contribution By Women Employees Reduced To 8 From 12 Mint

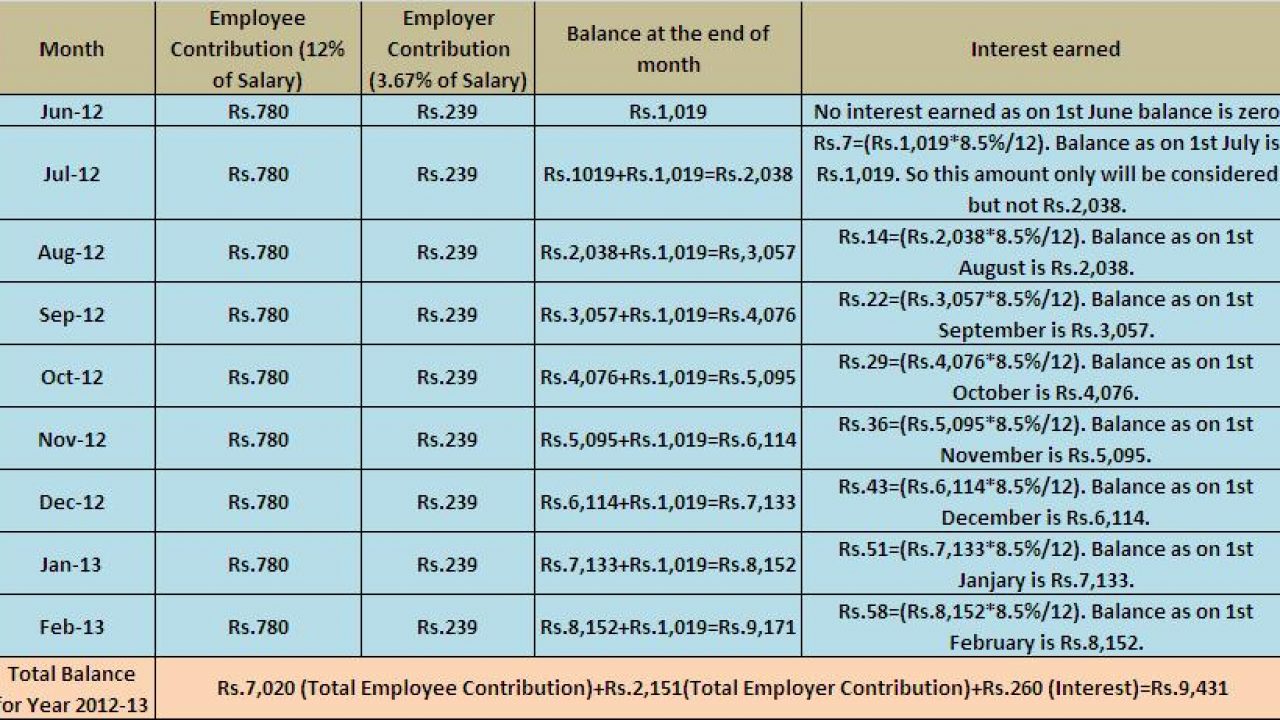

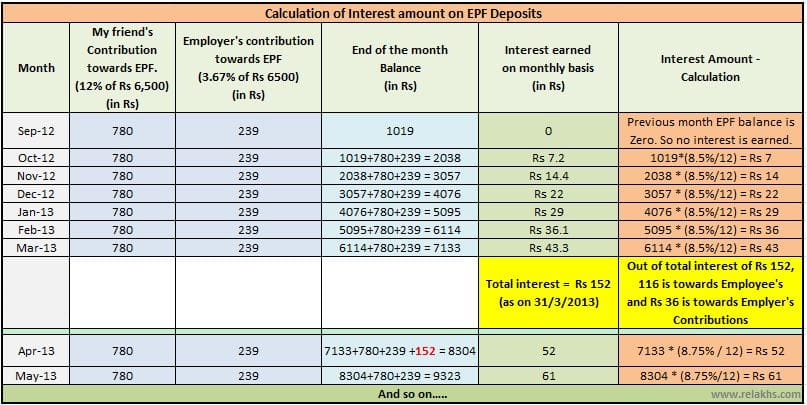

How Epf Employees Provident Fund Interest Is Calculated

Epf Rules For Employer 2018 19 Registration And Contribution Planmoneytax

Epf A C Interest Calculation Components Example

Epf Contribution Rates 1952 2009 Download Table

Epf Interest Rate From 1952 And Epfo

Basics And Contribution Rate Of Epf Eps Edli Calculation

Epf Contribution Rates 1952 2009 Download Table

Epf Contribution Rate 2018 Isaiahctzx

2019 Epf Updates Include Decreasing Senior Staff Contribution To 4

What Is The Epf Contribution Rate Table Wisdom Jobs India

Do You Know Epf Offers Up To Rs 6 Lakh Of Life Insurance Edli Basunivesh

20 Kwsp 7 Contribution Rate Png Kwspblogs

Epf Contribution Rate For Employee And Employer In 2019 Planmoneytax

Epf 8 Vs 11 Which Is The Best Choice For You

No comments for "epf contribution 2018"

Post a Comment